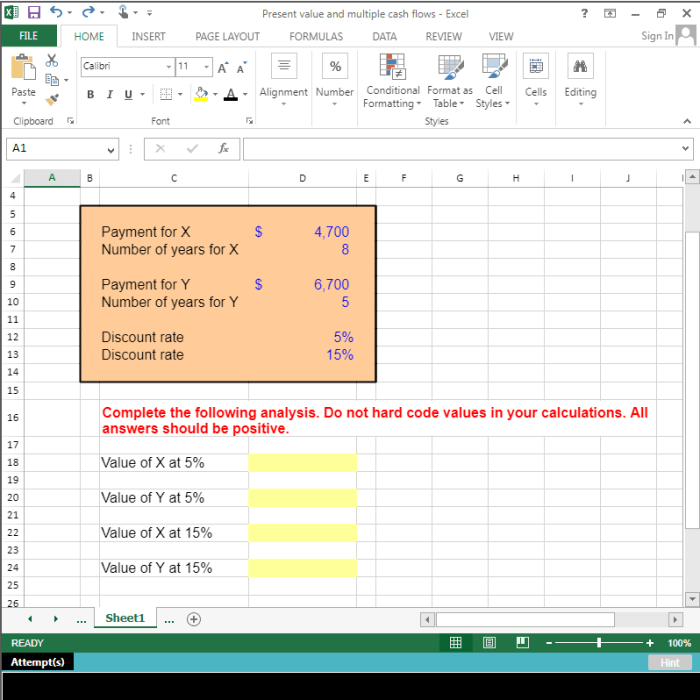

Investment X offers to pay you 4700, an enticing proposition that warrants thorough examination. Evaluating investment opportunities is crucial, and this article provides a comprehensive guide to assist you in making informed decisions. We will delve into financial analysis, company research, legal considerations, tax implications, and alternative investment options, empowering you to navigate the complexities of investment X.

Understanding the potential risks and rewards associated with investment X is essential. By carefully assessing the company’s reputation, financial health, and regulatory compliance, you can mitigate potential pitfalls. Moreover, exploring alternative investment options allows you to compare the potential returns and risks of investment X with other viable choices.

Investment Offer Evaluation

Evaluating investment offers thoroughly is crucial to avoid potential financial losses and scams. It involves assessing the risks and returns associated with an investment and ensuring that it aligns with your financial goals and risk tolerance.

To identify red flags and potential scams, consider the following tips:

Red Flags

- Unrealistic returns: Offers promising exceptionally high returns should raise suspicion.

- Lack of transparency: Be wary of investments that lack clear and detailed information about the underlying assets, management team, and fees.

- High-pressure sales tactics: Legitimate investment firms typically avoid aggressive sales tactics that pressure you into making quick decisions.

li>Unregistered or unlicensed: Verify that the investment firm and its representatives are registered with the appropriate regulatory authorities.

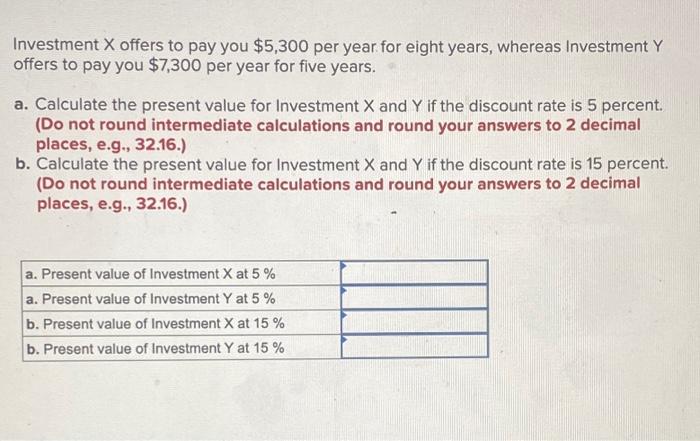

Financial Analysis

The financial analysis of Investment X involves evaluating its potential return on investment (ROI), assessing the risks and rewards associated with the investment, and comparing it to similar investment opportunities.

The potential ROI of Investment X is 4700. This means that if the investment performs as expected, the investor can expect to receive a return of 4700 on their initial investment.

Risks and Rewards

As with any investment, there are both risks and rewards associated with Investment X. The primary risk is that the investment may not perform as expected, and the investor may lose some or all of their initial investment. However, the potential reward is that the investment could perform well and the investor could receive a substantial return on their investment.

Comparison to Other Investments

When comparing Investment X to other similar investment opportunities, it is important to consider the following factors:

- The potential return on investment

- The risks associated with the investment

- The liquidity of the investment

- The tax implications of the investment

Company Research

Conducting thorough research on the company offering the investment is crucial to evaluate its reputation, financial stability, and compliance with regulatory requirements. This assessment helps mitigate risks and ensures informed decision-making.

Begin by examining the company’s reputation through online reviews, industry reports, and media coverage. Check for any negative news, lawsuits, or regulatory actions that could indicate potential issues.

Financial Health Assessment

Review the company’s financial statements, including balance sheets, income statements, and cash flow statements. These documents provide insights into the company’s financial performance, liquidity, and solvency. Analyze key financial ratios, such as return on equity, debt-to-equity ratio, and current ratio, to assess the company’s financial health.

Regulatory Compliance

Verify that the company is registered with relevant regulatory authorities and is in compliance with applicable laws and regulations. This includes checking for licenses, permits, and any industry-specific certifications. Compliance ensures that the company operates ethically and within established standards.

Legal Considerations

Before investing, it is crucial to thoroughly review the terms and conditions of the investment offer to identify any potential legal risks or obligations.

Investors should be aware of the legal implications associated with the investment, including their rights and responsibilities as an investor.

Legal Advice

Consider consulting with a financial advisor or attorney for legal advice to fully understand the legal implications of the investment offer and to ensure that it aligns with your investment goals and risk tolerance.

Tax Implications

The tax implications of an investment can significantly impact its overall return. Understanding the short-term and long-term tax liabilities associated with an investment is crucial for making informed decisions.

The tax treatment of an investment depends on various factors, including the type of investment, the investor’s tax bracket, and the holding period.

Short-Term Tax Implications

- For investments held for less than one year, any gains or losses are generally taxed as short-term capital gains or losses.

- Short-term capital gains are taxed at the investor’s ordinary income tax rate.

- Short-term capital losses can be used to offset short-term capital gains or up to $3,000 of ordinary income.

Long-Term Tax Implications

- For investments held for more than one year, any gains or losses are generally taxed as long-term capital gains or losses.

- Long-term capital gains are taxed at a lower rate than short-term capital gains.

- The long-term capital gains tax rate depends on the investor’s tax bracket.

- Long-term capital losses can be used to offset long-term capital gains or up to $3,000 of ordinary income.

Tax Incentives and Deductions

There are certain tax incentives and deductions that may apply to investments, such as:

- Retirement accounts (e.g., 401(k), IRA)

- Municipal bonds

- Investment interest expense deduction

Researching and understanding these tax incentives can help investors reduce their tax liability and maximize their investment returns.

Alternative Investment Options

Exploring alternative investment options can provide opportunities for diversification and potentially higher returns. Here are some viable alternatives to the offered investment:

Real Estate

- Advantages:Tangible asset, potential for rental income and appreciation, inflation hedge.

- Disadvantages:High transaction costs, illiquidity, property management responsibilities.

Private Equity

- Advantages:Potential for high returns, investment in non-public companies.

- Disadvantages:High minimum investment requirements, illiquidity, limited transparency.

Venture Capital, Investment x offers to pay you 4700

- Advantages:Investment in early-stage companies with high growth potential.

- Disadvantages:High risk, illiquidity, long investment horizon.

Commodities

- Advantages:Inflation hedge, diversification from traditional investments.

- Disadvantages:Price volatility, storage and transportation costs.

Comparison Table

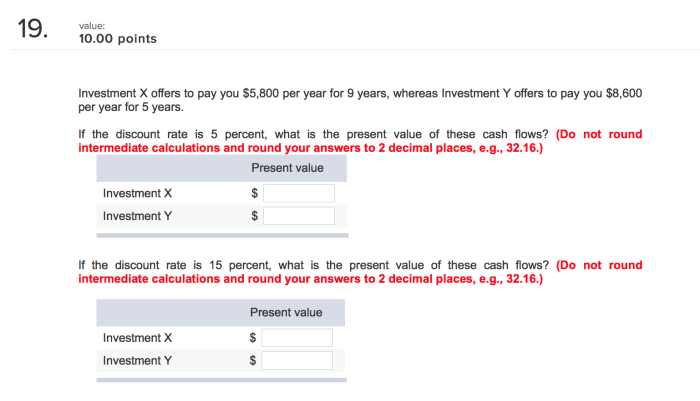

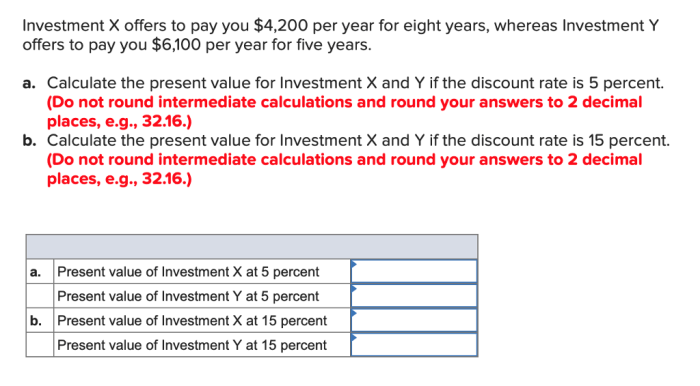

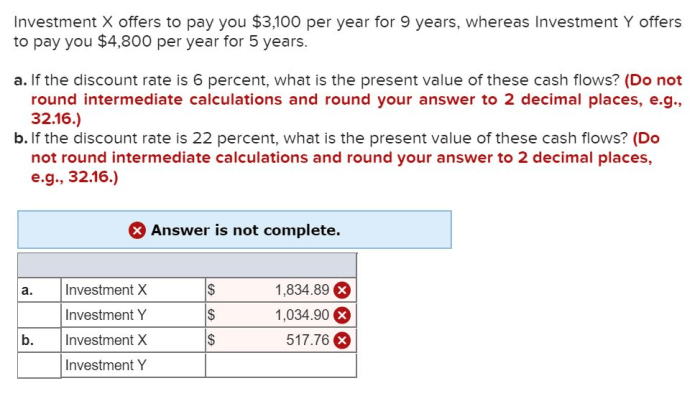

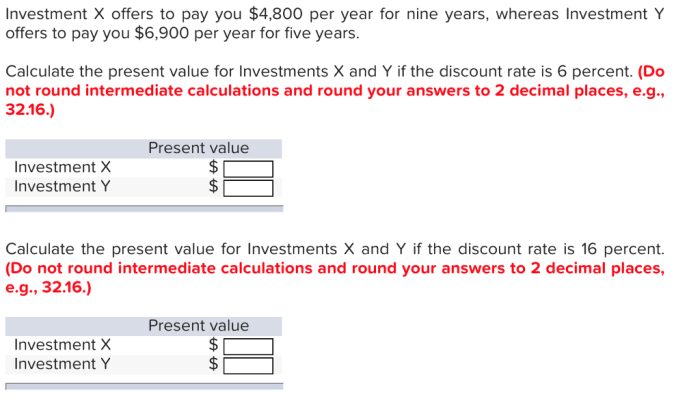

| Investment Option | Potential Returns | Liquidity | Risk |

|---|---|---|---|

| Investment Offer | 4700 | Medium | Medium |

| Real Estate | High | Low | Medium |

| Private Equity | Very High | Very Low | High |

| Venture Capital | Very High | Very Low | Very High |

| Commodities | Medium | Medium | Medium |

It’s crucial to note that the suitability of these alternative options depends on individual investment goals, risk tolerance, and time horizon. Diversification across multiple asset classes can help mitigate risks and enhance portfolio performance.

Decision-Making Process: Investment X Offers To Pay You 4700

Making informed investment decisions requires a systematic approach that considers various factors and follows a structured process. The key factors to consider include investment goals, risk tolerance, time horizon, diversification, and potential returns.

To evaluate and compare investment offers effectively, follow a step-by-step process:

- Define investment goals:Determine your specific financial objectives and align investment choices accordingly.

- Assess risk tolerance:Determine your comfort level with potential investment losses and tailor investments to your risk tolerance.

- Set time horizon:Consider the time frame over which you plan to invest and align it with investment options that meet your needs.

- Diversify portfolio:Spread investments across different asset classes and industries to reduce risk and enhance returns.

- Evaluate potential returns:Research and analyze historical performance, market trends, and expert forecasts to assess potential returns and align them with your financial goals.

To make informed choices, utilize a decision-making framework that includes the following steps:

- Gather information:Collect relevant data on investment options, including financial performance, risk profiles, and market trends.

- Analyze and compare:Evaluate investment options based on key factors, such as potential returns, risks, and alignment with your financial goals.

- Make a decision:Choose the investment option that best meets your specific needs and preferences, considering the factors analyzed.

- Monitor and adjust:Regularly review your investments and make adjustments as needed to ensure they remain aligned with your financial goals and risk tolerance.

Commonly Asked Questions

What are the key factors to consider when evaluating investment X?

Financial performance, company reputation, regulatory compliance, and tax implications are crucial factors to assess.

Are there any potential risks associated with investment X?

All investments carry some level of risk. It’s important to understand the potential risks, such as market fluctuations, company performance, and regulatory changes, before investing.

What are some alternative investment options to consider?

Stocks, bonds, mutual funds, and real estate are some common alternative investment options that offer varying levels of risk and return.