Luis wants to buy a home priced at 5 000 – Luis wants to buy a home priced at $315,000, and this guide will delve into the intricacies of homeownership, empowering him to make informed decisions throughout the process. From assessing his financial situation to navigating the closing process, this comprehensive resource provides a roadmap to successful homeownership.

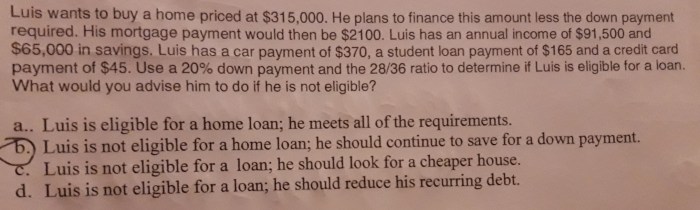

Understanding Luis’s financial capabilities, including income, expenses, and debt obligations, is paramount in determining his affordability for a $315,000 home. The analysis of his debt-to-income ratio and credit score will provide insights into his creditworthiness and ability to secure financing.

Luis’s Financial Situation

Luis is a 35-year-old single man with a stable job as a software engineer. He earns an annual salary of $100,000. Luis has a monthly take-home pay of approximately $6,500 after taxes and deductions.

Luis’s current expenses include rent ($1,500), utilities ($200), groceries ($400), transportation ($300), and entertainment ($200). He also has a car payment of $400 per month and a student loan payment of $200 per month.

Luis’s total monthly expenses are approximately $2,900. This leaves him with a monthly surplus of $3,600.

Luis has a debt-to-income ratio of 29% ($1,000 / $3,600). His credit score is 750.

Home Affordability

Based on Luis’s financial situation, he can afford a monthly mortgage payment of approximately $1,500.

For a $315,000 home, Luis would need a down payment of at least 20%, or $63,000. This would result in a monthly mortgage payment of $1,260.

If Luis chooses to make a smaller down payment, he will have to pay private mortgage insurance (PMI). PMI is a type of insurance that protects the lender in case the borrower defaults on the loan. PMI can add an additional $100 to $200 per month to Luis’s mortgage payment.

Homeownership Costs

In addition to the monthly mortgage payment, Luis will also need to budget for other homeownership costs, such as property taxes, insurance, and maintenance.

Property taxes in Luis’s desired location are approximately $3,000 per year. Homeowners insurance is approximately $1,000 per year. Maintenance costs can vary depending on the age and condition of the home, but Luis should budget for at least $1,000 per year.

Luis’s total monthly homeownership costs would be approximately $1,900.

Home Value and Market Conditions: Luis Wants To Buy A Home Priced At 5 000

The real estate market in Luis’s desired location is currently stable. Home values have been increasing steadily over the past few years, but there are no signs of a bubble.

Recent home sales data shows that the median home price in Luis’s desired location is $300,000. This is slightly lower than the price of the home that Luis is interested in, but it is still within his budget.

Home Inspection and Appraisal

Before Luis makes an offer on a home, he should have a home inspection performed. A home inspection is a thorough examination of the home’s condition. It can identify any major problems that could affect the value of the home or the cost of ownership.

Luis should also get an appraisal. An appraisal is an estimate of the home’s value. The appraisal will be used by the lender to determine how much money to lend Luis.

Closing Costs and Timeline

Closing costs are the fees that are paid at the closing of a real estate transaction. These costs can include the lender’s origination fee, the attorney’s fee, the title insurance fee, and the recording fee.

Closing costs typically range from 2% to 5% of the purchase price. For a $315,000 home, Luis can expect to pay approximately $6,300 to $15,750 in closing costs.

The closing process typically takes 30 to 45 days.

Helpful Answers

What factors influence home affordability?

Income, expenses, debt obligations, down payment, interest rates, and property taxes.

What is private mortgage insurance (PMI)?

PMI is an insurance premium paid by borrowers with a down payment of less than 20%, protecting the lender in case of default.

Why is a home inspection important?

A home inspection identifies potential issues with a property that may affect its value or habitability, allowing buyers to make informed decisions.